How to Enroll for EFTPS to pay Taxes electronically

In the 21st century, less and less checks are being written and more and more payments are being made electronically. Many taxpayers do not know that they can enroll for EFTPS to make IRS payments. By enrolling for the Electronic Federal Tax Payment System (EFTPS), businesses and individuals can set payments to be direct debited from their bank account to the IRS. No more lost checks or delays. This post is a step by step guide on how to enroll for EFTPS to start making IRS payments easier.

Enroll for EFTPS

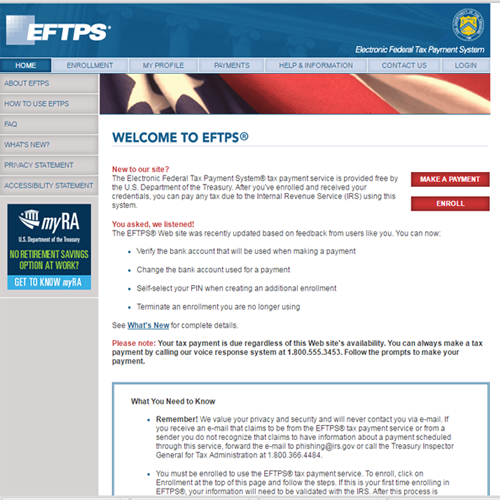

The first step to enroll for EFTPS is to go to www.eftps.gov. Once you reach the landing page, there are two red buttons that you can choose from. One button is for making payments, and the other says “Enroll.” Click “Enroll” to begin the enrollment.

The Application – Step 1

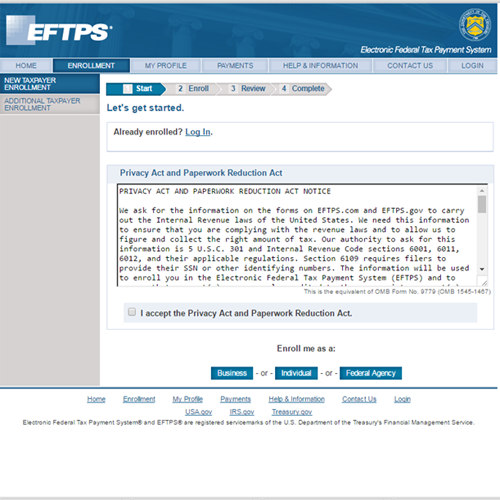

Once you begin the enrollment, the next step is to read the privacy agreement. If you accept, check the box that begins with “I accept…” After you check the box, at the bottom of the page you have 3 options for enrollment: Business, Individual, or Federal Agency. Most of you will select Business or Individual. This takes us to Step 2..

The Application – Step 2

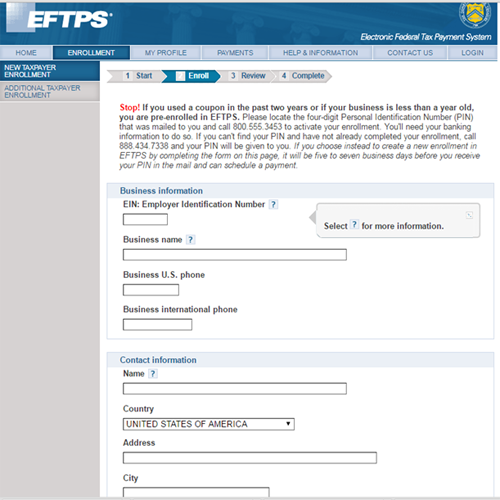

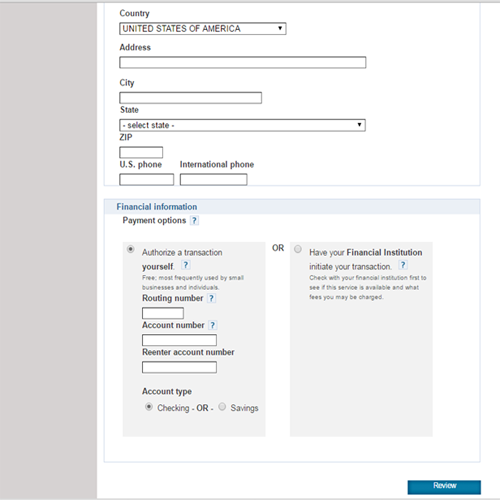

Step 2 is where you provide all of the information needed to create your account. This includes items such as the EIN (Employer Identification Number for businesses), Business Name, Phone Number, Contact Person, and Address. The very last section of this application step is where you provide your bank information for making future payments, such as the Routing Number, Account Number, and type of account (Checking or Savings). When you are done entering all the information, click “Review” at the bottom of the page to proceed to the next step.

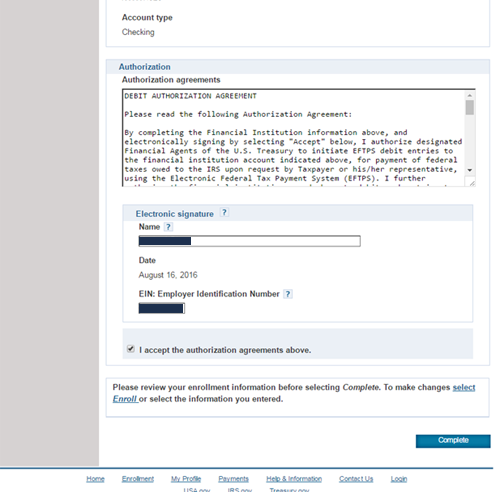

The Application – Step 3

After you have entered all the information requested, Step 3 is where you are given a chance to review all of the information that you entered in Step 2. Review all of the information carefully to ensure that it is correct. This step is completed by signing the application electronically and re-entering your EIN/SSN. There is also an Authorization agreement for you to read and accept by checking the box below your signature that says “I accept…” Once you have signed the application, click “Complete” and the bottom of the page to submit your enrollment request.

The Application – Step 4

Your enrollment request is now submitted. Please make sure to print the confirmation page (or save the PDF file) for your records. You should receive a letter with a PIN (and enrollment number) in the mail in about 7-10 business days. This letter is important to be able to make payments in the future and create your own unique password for logging in.

After you receive the PIN in the Mail

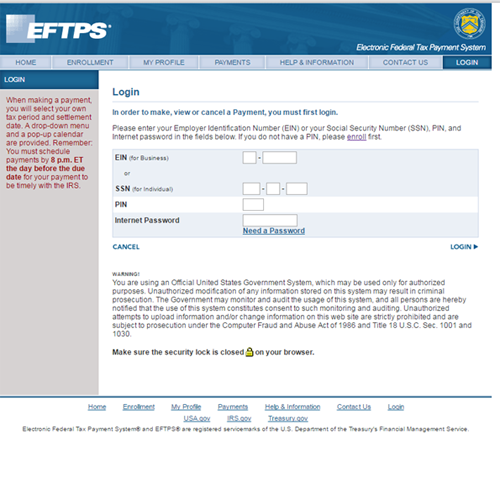

Once you have received your PIN number in the mail, make sure to write it down and keep it in a safe place. You will need the PIN number to be able to make future EFTPS tax payments. I suggest scanning the letter and saving on your computer as backup. With the PIN you can also create your own unique password that you will also need to make payments. To create your unique password, go back to www.eftps.gov and click “Login” in the top right. From the Login screen, select “Need a Password” under “Internet Password.”

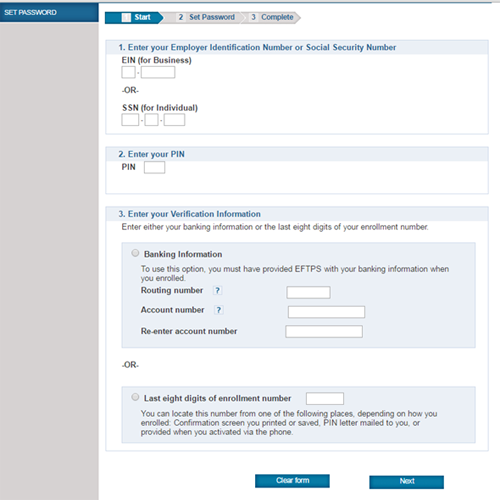

Just like the enroll for EFTPS process, there are a couple of steps to create your unique password. In Step 1, you will need to enter the EIN or SSN, the PIN number you received in the mail, and either the bank information you provided with your enrollment request, or the last 8 digits of your enrollment number (which is also included in the letter that you received with the PIN number). Once you verify your information, you can create your unique password and your EFTPS enrollment is officially complete. You can start making payments by going to the main page and selecting “Make A Payment.”

For more information regarding the EFTPS enrollment process and assistance with enrolling or making payments, please email us at [email protected].

References:

how to submit an eftps payment when a brokerage account and not a checking/savings account is used.

When using the brokerage account, the deposit is rejected.

How to correct?

Adobe Flash Player will reach end of life December 31, 2020. Will this change affect EFTPS payment system login and payments?