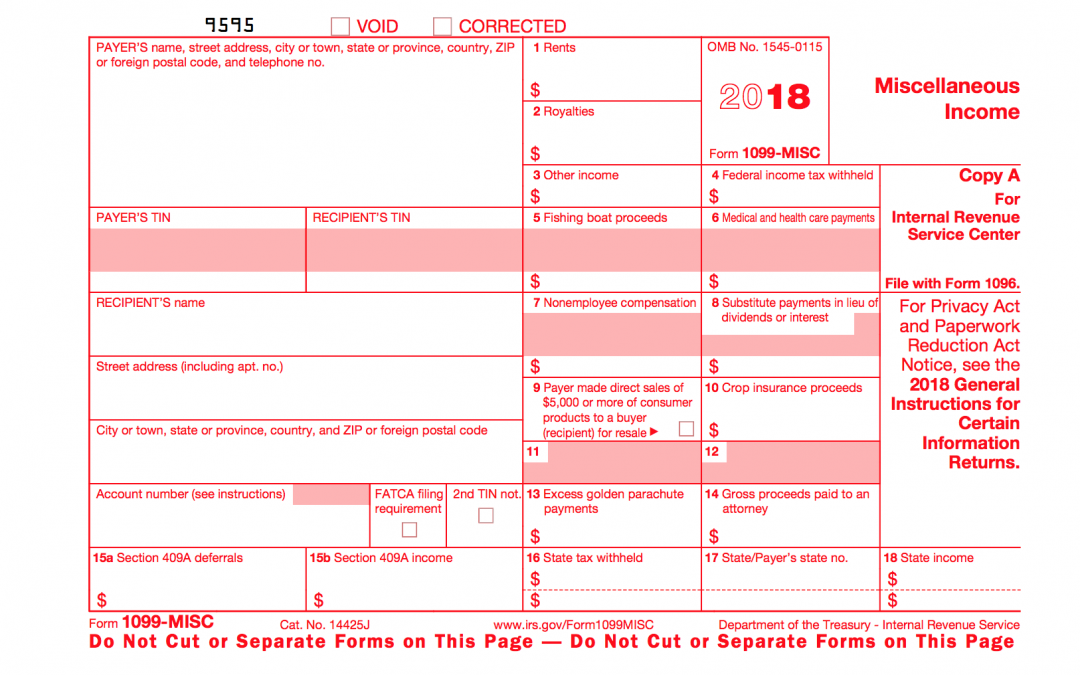

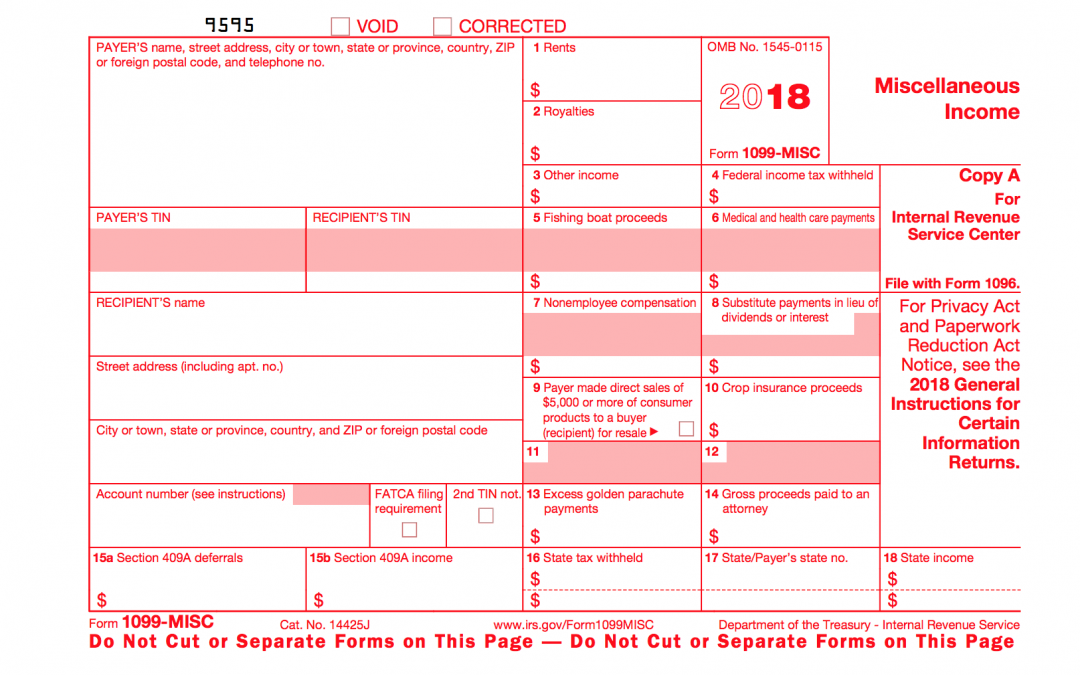

by Omar Valenzuela, CPA | Jan 23, 2019 | Taxes |

In general, all businesses that pay any individual or non-corporate entity performing services in the U.S. $600 or more during a year, are required to file a Form 1099-MISC with the Internal Revenue Service…

by Omar Valenzuela, CPA | Jan 24, 2018 | Taxes |

Are you ready for Tax Season 2018?

The following are some tax deadlines to be aware of in 2018…

by Omar Valenzuela, CPA | Feb 10, 2017 | IRS |

One of the most important pieces of information that the IRS always needs on file is your address.

Fortunately, the IRS offers taxpayers a few different options to notify them of any address change…

by Omar Valenzuela, CPA | Jan 25, 2017 | Taxes |

Another tax season is officially upon us…

Yes, we know you are excited.

Here are some tax deadlines to be aware of in 2017…

by Omar Valenzuela, CPA | Aug 25, 2016 | IRS, Taxes |

In the 21st century, less and less checks are being written and more and more payments are being made electronically.

By enrolling for the Electronic Federal Tax Payment System (EFTPS), businesses and individuals can set Federal tax payments to be direct debited instead…

by Omar Valenzuela, CPA | Jun 6, 2016 | International |

The Report of Foreign Bank and Financial Accounts, also known as the FBAR, is a disclosure form for reporting the highest balance achieved during the year of each and all foreign financial accounts.

The Form applies to both individuals and businesses.

The penalty for not filing the Form can be $10,000 or more…

by Omar Valenzuela, CPA | Feb 15, 2016 | Taxes |

Have you filed your 2015 tax returns yet?

Don’t wait til the last minute!

The following are some deadlines to be aware of for the 2016 tax season..