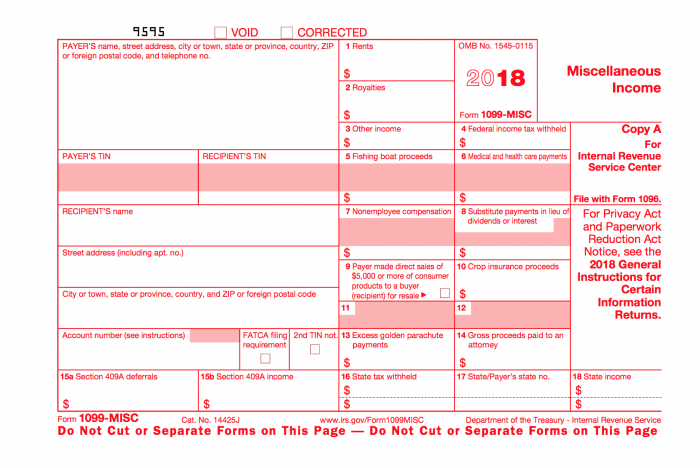

2018 Forms 1099-MISC – Due January 31, 2019

**Reminder: Government copies are due by January 31 if reporting nonemployee compensation in box 7**

In general, all businesses that pay any individual or non-corporate entity performing services in the U.S. $600 or more during a year, are required to file a Form 1099-MISC with the Internal Revenue Service for each payee, as well as provide a copy to each payee.

Penalties

The penalty for 2018 for not filing a required Form 1099 can be $270 per Form 1099 for failure to file, as well as $270 per Form 1099 for failure to provide a copy to the payee, or $540 total per Form 1099. If the failure to file is due to intentional disregard, the penalty is doubled and can be $1,080 per Form 1099 required.

Non-filed Form 1099s has become an area of focus by the IRS during audits. In addition, there is a Yes or No question on all business income tax returns that asks if any payments were made during the year that require a Form 1099, and whether the Forms were or will be filed.

FAQs

Below are some Frequently Asked Questions about the Form 1099-MISC requirement:

1. I paid someone more than $600 through PayPal. Do I have to issue them a Form 1099-MISC?

Answer: No. Payments to individuals or non-corporate entities made through a third-party payment processor such as a credit card, PayPal, or Stripe, are not subject to the Form 1099-MISC filing requirements. These payments are subject to Form 1099-K reporting, which will be issued by the third-party payment processor, if required.

2. Is Venmo or Zelle considered a third-party payment processor and therefore, not subject to the Form 1099-MISC filing requirements?

Answer: No. Venmo, Zelle, and other similar applications facilitate cash transfers only. They are not a merchant payment processor. Therefore, a Form 1099-MISC is required for payments made using these applications.

3. I paid an LLC. I do not have to issue them a Form 1099-MISC, right?

Answer: It depends. The only taxable entity for which payments are not subject to Form 1099 filing requirements are corporations. For tax purposes, an LLC can be a partnership, sole-proprietor, or corporation. Therefore, the only way you can know for sure how an LLC is taxed is by having them fill-out a Form W-9.

You can download a copy of Form W-9 here. The Form will provide you with all the information that you would need to prepare a Form 1099-MISC, if required.

Note: You should always request that your new contractors fill-out a Form W-9 as part of the hiring process.

Additional Information

For more information regarding Form 1099-MISC filing requirements, please visit the following links:

General Instructions for Certain Information Return: https://www.irs.gov/pub/irs-pdf/i1099gi.pdf

Instructions for Form 1099-MISC: https://www.irs.gov/pub/irs-pdf/i1099msc_18.pdf

If you need assistance filing a Form 1099-MISC, please contact us at info@miamicpabay.com.